[ad_1]

Posted 5/24/24 | May 24th, 2024

I never leave home without travel insurance. After over 15 years on the road, I’ve learned firsthand how important it is. Not only has it helped me deal with lost luggage, canceled flights, and medical emergencies, but it’s helped countless friends and readers of my blog too.

However, travel insurance is a boring topic to read about. Nobody likes comparing plans and reading policies. Myself included. It’s the least exciting part of trip planning.

Fortunately, it’s never been easier to find a plan and policy that suits your needs and budget. More and more companies are making it fast and simple to get a quote, sign up for a plan, read the fine print, and make a claim.

One of those companies is Freely.

What is Freely?

Freely is a travel insurance company and safety app. Like many insurance companies, it provides coverage so you can be made whole should something happen (for a covered reason) while you’re on the road. Its base plan includes all the essentials I look for in an insurance policy, including emergency medical care, emergency evacuation coverage, trip interruption, lost baggage, and 24/7 support.

But Freely does a few things differently too.

Freely keeps its base policy affordable by not including additional coverage that you might not need. But you can upgrade, for example, to get extra coverage for your gear in case you’re bringing valuable electronics or sporting equipment with you. This is a big plus since most travelers bring a phone or laptop with them (often both).

With most other plans, your gear is only covered up to $500 USD per item. Freely lets you add on to your plan to cover your gear up to $1,500 USD per item.

But what’s really useful (and unique) is Freely’s Daily Boost supplement.

Daily Boosts are insurance add-ons for things you won’t need every day, such as coverage to go skiing, rent a car, or go skydiving. Paying for these add-ons only when you need them (on a day-by-day basis) ensures that your policy as a whole remains less expensive — but you get the coverage you need when you need it.

For example, snow or adventure activities cost just $1 USD per day, while rental car coverage is $15 USD per day (pricing varies by state). If you only are going skiing for a few days of your trip or won’t be renting a vehicle for your entire vacation, the daily boost ensures you aren’t paying for what you don’t need.

What Does Freely Cover?

Freely policies have a pretty wide range of coverage. Currently, plans include coverage for the following:

Emergency Medical Expenses

This is the most important component of any insurance plan. It’s what will come into play if you fall down some stairs and break a leg or are hospitalized because you get hit by a car, get sick, etc. In short, if you’re sent to a hospital or doctor, this is what offers you emergency medical coverage.

I always recommend travelers have at least $100,000 USD in coverage because hospital bills add up fast. Freely offers $500,000 USD in coverage on the base plan. That’s a high limit and can cover you for everything the road throws your way.

Emergency Evacuation and Repatriation

Medical and emergency evacuations can be incredibly expensive. These might be required if you get injured while hiking and need to be airlifted to the hospital, or if you have to be repatriated to your home country.

Incidents like these can cost upwards of $250,000 USD, which is enough to bankrupt most travelers. Fortunately, Freely’s base policy covers up to $1,000,000 USD for emergency evacuations. That’s more than a lot of other insurance companies offer should you need an emergency evacuation.

Emergency Dental Expense

I always appreciate travel insurance policies that cover emergency dental care. Freely offers $1,000 USD for emergency coverage on its base plan. This doesn’t mean you can go get a dental check-up if you have a cavity or want a cleaning, but rather that you’ll be able to see a dentist should you experience an unforeseen emergency or sudden pain while on your trip.

Accidental Death and Dismemberment

Nobody wants to think about the worst-case scenario of dying on the road (I sure don’t) but knowing that your insurance policy can cover these eventualities offers a lot of peace of mind. For example, the policy pays $50,000 USD for accidental death, which (not to get too morbid) will likely be helpful to your loved ones should the worst occur.

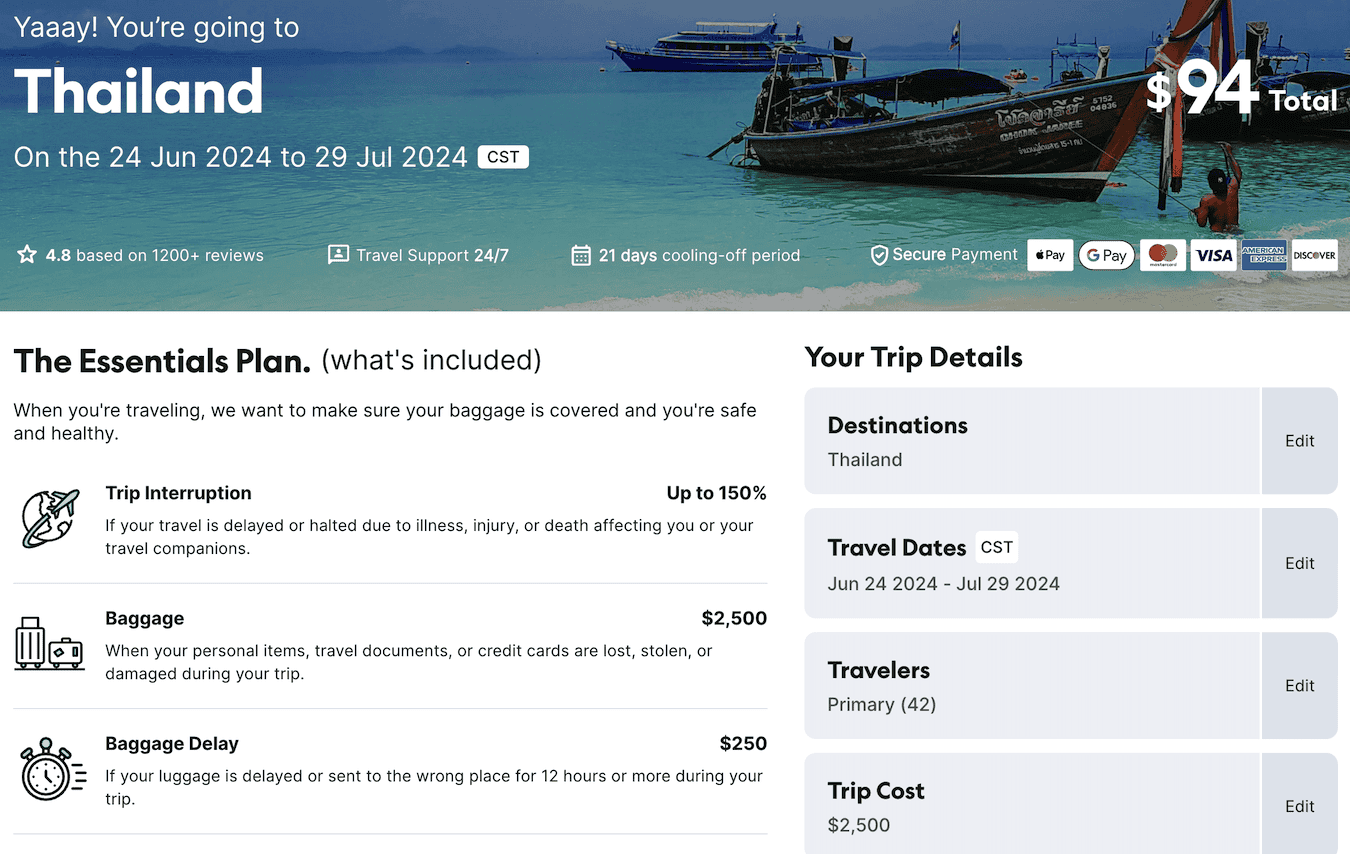

Trip Interruption

When you miss part of your trip or have to return home early due to eligible unforeseen circumstances (such as illness or injury), Freely will reimburse you up to 150% of the cost of the trip. Considering how often flights are delayed and how often a natural disaster occurs, this is a solid addition and something not a lot of affordable plans include.

Lost, Stolen, or Damaged Baggage

Freely’s coverage for lost or stolen baggage is similar to other companies, in that there’s a per-item limit of $500 USD and a total cap of $2,500 USD. While that’s good for a lot of gear, such as a basic digital camera or sporting equipment, it may not cover the entire price of a laptop or more heavy-duty camera.

However, as I mentioned above, you can buy an add-on for additional coverage. This will bump your baggage per-item limit to $1,500 USD and the total limit to $5,000 USD. Your electronic and professional equipment coverage is $2,000 USD, which provides substantial coverage for your phone or laptop.

While the cost for this upgrade will vary, using the example below (a month long trip to Thailand), it would cost around $23 USD for the add-on. That’s super affordable.

Baggage Delay

This is a nice perk for anyone who isn’t traveling carry-on only. Essentially, if your luggage is delayed 12 hours or more, you’ll qualify for up to $250 USD so you can buy necessary clothing and personal items (within a reasonable limit). With Baggage Upgrade this benefit can be increased by $100 USD.

Note: As with any insurance plan, you’ll want to read the fine print of your policy for more information. Additionally, details might be different based on where you live, so always double-check while researching just to be safe.

What’s NOT Covered?

Freely is primarily geared toward covering medical emergencies and basic travel mishaps (like delays and lost luggage). It’s good practice to tell you what’s not covered, such as the following:

- Alcohol- or drug-related incidents

- Any electronics over $500 USD (without an add-on)

- Certain high-risk activities (e.g., driving in a motor vehicle competition)

- Participation in professional or amateur athletics competitions

- Losses incurred because of a pre-existing medical condition.

If you’re not sure if the activity you want to do is covered, or if you want more information about what is not covered, reach out to Freely directly.

Currently, Freely’s policies are available only to residents of the US and Australia. Coverage described in this article is specific to the US product.

How Much Does Freely Cost?

You can get a quote online at freely.me in less than one minute. You just need to input basic information, like where you live, where you’re going, how long you’re traveling for, and how much your trip costs.

For example, someone aged 30 going from the US to Thailand for one month will pay around $40 USD for base coverage. That is for a trip costing around $2,000 USD and not including any extras or Daily Boosts.

Click here to get a quote from Freely.

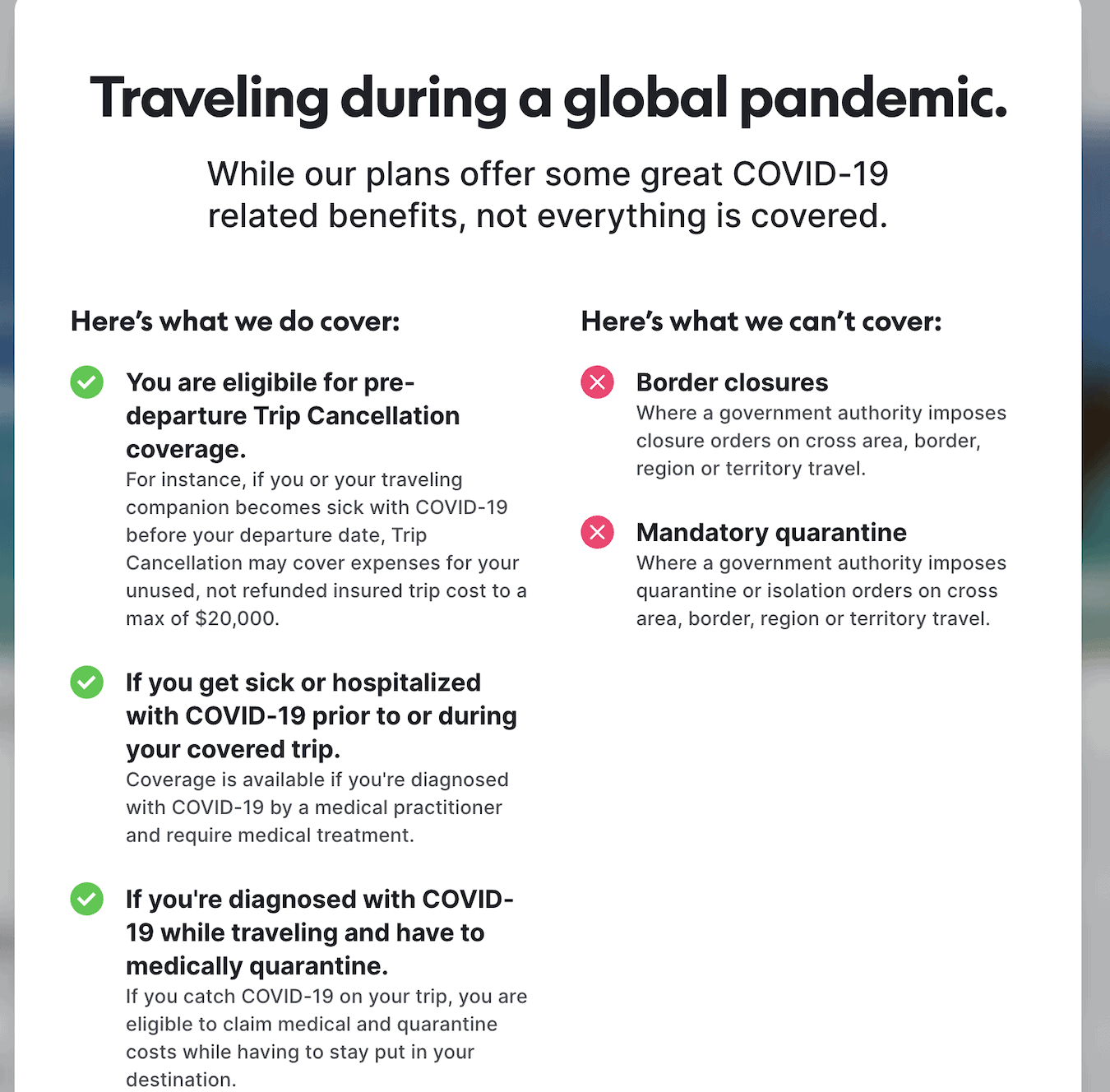

One thing I like about Freely when it comes to getting quotes is that they tell you what isn’t covered. A lot of companies just imply that (i.e., if it’s not mentioned, it’s not covered).

Freely, on the other hand, explicitly adds reminders of what is not covered when you’re looking for a policy, so as to ensure that your expectations are accurate.

Pros of Freely

- 24/7 emergency assistance

- Emergency medical coverage

- Emergency Evacuation and trip interruption coverage

- Coverage for lost, stolen, or damaged baggage

- COVID coverage

- Daily add-ons available for extra gear and activities

Cons of Freely

- Only available in the US and Australia

- Downloading the app is required

Who is Freely For — and NOT For?

Freely is very affordable, making it a solid choice for backpackers and budget travelers. Long-term travelers who are more flexible with their plans will also appreciate being able to update their policy right in the app.

It’s also a great choice for adventurous travelers since you can add Daily Boosts for things like skydiving, scuba diving, etc.

Freely’s app also sends out safety alerts and COVID updates, making it a good option for those concerned about safety issues. Because Freely relies on an app, they’re able to pinpoint your location to ensure important local safety updates get to you. I can’t think of another insurance company that offers that kind of service, ensuring your peace of mind no matter where you’re going.

On the flip side, Freely may be frustrating for anyone who doesn’t want to download and use an app. Most of Freely’s services (making a claim, changing or updating your policy) are only available in the app. While this makes it streamlined and convenient in some ways, those who want to be able to access and manage their account on a computer might want to choose a different company.

I think buying travel insurance should be a simple and straightforward process. Finding a policy shouldn’t be totally mind-numbing or time-consuming. And while Freely is still quite new on the market, it has a lot of potential. Its app makes finding the information you need a breeze, and the extras and Daily Boosts add customization I hope more companies embrace. I think it’s a worthwhile company to check out when you’re shopping around for a plan.

Click here to learn more and get a quote today!

Book Your Trip: Logistical Tips and Tricks

Book Your Flight

Use Skyscanner to find a cheap flight. They are my favorite search engine because they search websites and airlines around the globe so you always know no stone is left unturned.

Book Your Accommodation

You can book your hostel with Hostelworld as they have the biggest inventory and best deals. If you want to stay somewhere other than a hostel, use Booking.com as they consistently return the cheapest rates for guesthouses and cheap hotels.

Looking for the Best Companies to Save Money With?

Check out my resource page for the best companies to use when you travel. I list all the ones I use to save money when I’m on the road. They will save you money when you travel too.

Want to Travel for Free?

Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip?

Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.